The merger of provinces and cities effective July 1, 2025, presents a pivotal opportunity to reshape Vietnam’s real estate market—but also introduces risks such as speculative land bubbles, distorted supply, and imbalanced end-user demand.

Siêu Đô Thị TP. HCM Mở Rộng: Tái Định Hình Thị Trường Bất Động Sản Vùng

Entering the second half of 2025, Vietnam faces a historic turning point as the country reduces its provinces and cities from 63 to 34 administrative units. This strategic decision not only aims to streamline the system but also raises hopes for forming mega-economic zones, accelerating urbanization, and enhancing national competitiveness. However, it also raises issues related to land, planning, and fluctuations in the real estate market.

According to Sen Vàng Real Estate Research Company, the nationwide merger of provinces will create new momentum for infrastructure, industry, logistics, and tourism development. Future mega cities like the expanded Ho Chi Minh City (merging with Binh Duong, Ba Ria – Vung Tau) or Hai Phong (merging with Hai Duong) are expected to become new economic hubs.

However, the outlook is not entirely positive as the market faces numerous challenges. Existing project developers may encounter legal bottlenecks as boundaries and master plans must be adjusted. The lesson from Ha Dong after the merger of Ha Tay into Hanoi in 2008 still holds value, when many projects had to reapply for detailed 1/500 planning approval, increasing costs and delaying progress.

Individual investors—who make up a significant portion of the secondary market—face the risk of falling into a FOMO (fear of missing out) trap. Land fever episodes in Phu Quoc, Thu Duc, Ha Tay, or Long An in the past have led to problems in liquidity and real value.

For landowners, especially those in peri-urban areas awaiting planning updates, the merger may mean frozen transactions, delayed legal documentation, and additional paperwork costs.

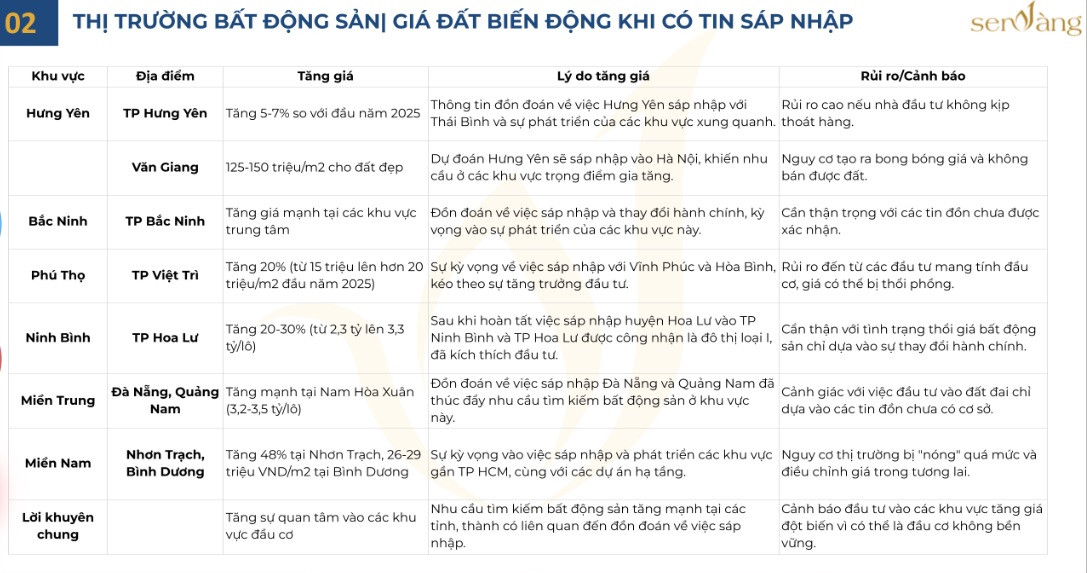

Land Price Fluctuations Prior to the Merger – Source: Senvangdata

In terms of segments, suburban land plots are the most sensitive to the merger news. History shows that land prices in areas like Binh Duong, Dong Nai, and Long An once rose by 30–50% within months of rumored boundary changes or urban expansion. But after the “wave,” prices often drop and liquidity declines.

The apartment segment, especially in mega urban areas near new infrastructure axes, will benefit in the long term. However, rising land costs make housing less accessible to the middle class.

Meanwhile, the social housing segment—critical for low-income earners—risks being overwhelmed by commercial projects. For example, in Thu Duc City between 2020–2022, social housing supply nearly froze as land was prioritized for high-end segments.

Tourism real estate can leverage cross-provincial benefits for integrated tourism development, but overlapping plans and inconsistent policies between former and new local governments remain significant obstacles.

The Hanoi–Ha Tay merger in 2008 and past land fever episodes in Long An, Me Linh are clear warnings about speculative real estate bubbles. Land prices in Ha Dong and Me Linh once surged 40–70% (2008–2010) before crashing and staying stagnant for over a decade. Without strong controls, the market could spiral into a cycle of speculation, freeze, and illiquidity.

Before July 1, 2025, similar scenarios are forecast in “hot” areas such as Di An, Phu My, Nhon Trach, or VSIP Hai Duong. The imposition of unified land pricing without a proper roadmap could irrationally inflate land values.

Illustrative Image

Actual homebuyers—the most vulnerable group—may be excluded from the market as prices soar beyond affordability. Social housing risks further marginalization if local authorities fail to allocate suitable land funds.

Sen Vàng Group recommends that to minimize land-related risks, local governments must disclose planning information and priority development zones early. The Me Linh land fever teaches that lack of transparency fuels mass speculation.

Authorities must enhance transaction oversight, strictly handle price manipulation, flipping, and fake deals. At the same time, accelerating approvals for social housing, especially in industrial zones, is crucial to meet actual demand.

In the long term, investment in regional infrastructure like Ring Roads 3 and 4, North-South expressways, and coastal roads should be prioritized to expand land supply and reduce price pressure on old urban centers. Implementing Transit-Oriented Development (TOD) around public transit routes is also essential, especially as merged provinces grow in size.

Additionally, tax policies such as progressive taxes on unused or short-term flipped land should be enforced to curb speculation.

Experts believe that the coming market is not for trend-chasing investors. Instead, early entrants with strategic vision—those who understand zoning plans, focus on infrastructure-connected zones, have long-term financial capacity, and work alongside local governments—will be the real winners.

The provincial merger is a strategic move, but without tight control, Vietnam’s real estate market risks repeating cycles of overheating and freezing. In the new era with a two-tier government system and 34 provinces from July 1, 2025, decisive governance and long-term vision will be key to ushering in a healthy and sustainable real estate development cycle for Vietnam.

|

The above is an overview of the article “Vietnam’s 34 Provinces and Cities: Restructuring the Real Estate Market“ provided by Sen Vàng Group. We hope this information provides investors, developers, and real estate businesses with a broad perspective on the development potential of the property market. For more articles and insights on project development consultancy, please visit our website: senvangdata.com.vn/. |

|

————————–

Sustainability Report Consulting Service: Learn More

Explore more services and resources from Sen Vàng:

Analysis and comparison of the top 3 most luxurious condominium projects in Hanoi

Highlights of the Tay Ho real estate market – February 2025

Key insights into the Tay Ho property market – Early 2025

————————–

Sen Vàng Real Estate – A reputable and professional real estate development consulting firm in VieSWam.

Website: https://senvanggroup.com/

Website: https://senvangdata.com/

Youtube: https://tinyurl.com/vt82l8j

Hotline: 0948 48 48 59

Join our Investment Community Group: https://zalo.me/g/olgual210

#senvanggroup #senvangrealestate #senvanginvestmentchannel #project_development_consulting #real_estate_market_2023 #project_development #strategic_business_consulting #development_planning #project_marketing_strategy

Copyright © 2022 Bản quyền thuộc về SEN VÀNG GROUP